Swale’s Housing Market – The Honest Truth’s

With the announcement last week from the Bank of England that the base rate is rising from 4.5 to 5%, this can cause a lot of worry and confusion for anyone trying to hoping to buy or sell a home. With this in mind, we thought we would take a moment to explain what we are seeing in the Swale Housing Market currently

With the announcement last week from the Bank of England that the base rate is rising from 4.5 to 5%, this can cause a lot of worry and confusion for anyone trying to hoping to buy or sell a home. With this in mind, we thought we would take a moment to explain what we are seeing in the Swale Housing Market currently, how we think this may impact property sales in the short term and what you can do to ensure you are able to move regardless.

Don’t believe the hype

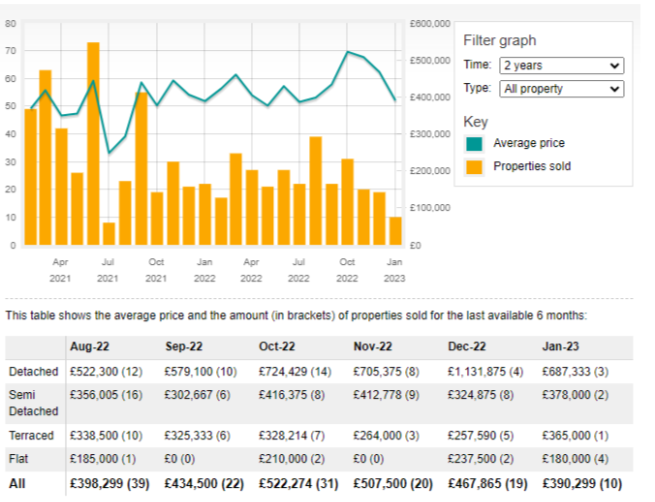

The mainstream media may have you thinking the property market is on the verge of collapse, this simply isn’t true, many parts of the UK, particularly in the North, are still seeing house prices increasing. For us in the South East, who are in much closer proximity to London, we are seeing prices adjusting, whilst it feels that house prices are falling, they have only dropped back to the pricing in July 2021 (see chart).

The average UK home has risen in value by £48 a day since February 2020. That’s equivalent to £38,000 and higher that the average UK salary.

The whole of the Swale property market has out performed this, with ME9 postcode increasing by £78 a day (£62,000) for the same period.

In truth, parts of the local market are struggling. If you are trying to sell a home over £500,000, you will need to have a strong marketing strategy and be realistic, and proactive in how you negotiate offers.

Fall through rates (sales that were agreed and one party withdrawing from the sale) are rising. Currently over a third of all sales don’t make it to completion, however if you use a reservation agreement, this figure drops significantly.

The Silver Lining

Before you despair, it’s not all doom and gloom, there are pockets in the Swale housing market that are holding up well, with many properties still receiving multiple offers, and many agreeing a sale over asking price. We have also noticed an increase in buyers registering for our Heads Up Property Alerts Service. The biggest group of these are first time buyers, we are also encouraged to see London buyers returning.

Our Straight Forward Advice to Secure a Sale

Here are a few of our top tips of how to secure a sale in the current Swale housing market

- Ensure all your paperwork and finances are in place before listing your property for sale

- Do not price your house too high when you initially list it for sale

- When comparing agents, ask for evidence of comparable sales before June 2021 to have a more realistic idea of your home’s current value

- Choose an agent that has a strong marketing strategy away from just listing on property portals

- Choose an agent that can demonstrate outstanding negotiating skill – If you can haggle them down on their commission rate, they probably aren’t going to be good at negotiation the best price for you.

- Sales aren’t the same as completed sales. Agents claiming to have sold more houses than competitors are only talking about offers being agreed. Ask for evidence of how many sales they have completed and what their fall through rate is.

- Choosing a cheaper agent often costs you money rather than giving you a saving.

- Always use a reservation agreement, if a buyer/seller/agent or solicitor is resistant to using them, this should ring alarm bells that someone isn’t as committed to the sale as they claim they are.

If you would like some honest, straight forward advice as to how you can sell your home, contact the Harrisons team on 01795 474848