What does the future hold for for borrowers? will they continue to benefit from low interested rates?

- The low interest rate environment the UK has experienced for over the past decade is set to remain, although rates are anticipated to rise.

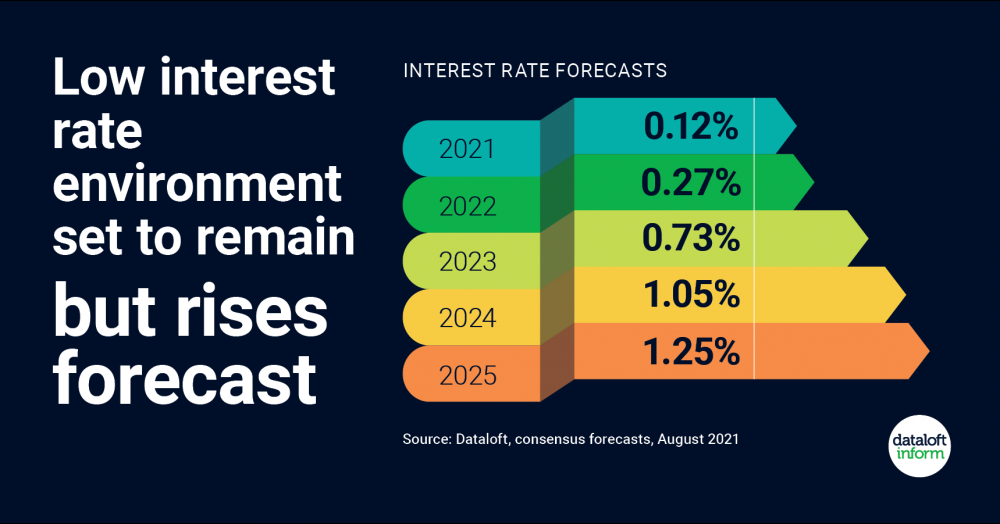

- The consensus forecast, based on the expectations of 18 different city and non-city analysts, expects interest rates will nudge slightly higher over the final quarter of 2021, ending at 0.12%.

- The base rate of interest has been 1% or lower since February 2009 when rates were slashed in the wake of the Global Financial Crisis. Rates may well rise back to 1% in 2024.

- The cost of borrowing remaining low is positive news for the housing market and those with a mortgage. The current average mortgage rate is just 2.05%, a historic low (Bank of England). Source: Dataloft, consensus forecasts, August 2021